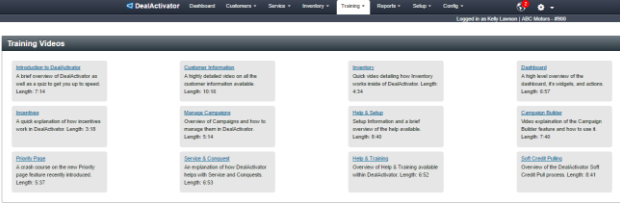

By: John Hardacre, Product Manager

Conquest business directly from your dealership’s service drive with Dominion DealActivator’s Soft Credit Pulls. Start pre-screening your service customer’s credit in real-time. It’s quick, easy and doesn’t affect the customer’s credit score. With Soft Credit Pulls, automotive dealers can see which customers are in equity positions while those customers are still on the lot. This is possible regardless of whether or not a customer has previously purchased from your specific dealership.

Dominion Dealer Solutions takes today’s automotive dealerships to the next level with real-time bank agnostic soft credit pulls. The dealership retains ownership of the firm offer of credit at all times. These reports do not require date of birth, social security number, or customer consent and are fully compliant with the Fair Credit Reporting Act.

Real time soft credit pulls are the “on demand pull of preference”; perfect for when immediate customer information is needed in the dealership’s service drive.

Dominion’s DealActivator now offers batch processing for these reports as well. These run overnight following dealer-specified criteria; providing your dealership with new batches of credit and equity summaries each morning. If you’re a current DealActivator customer and have yet to start using Soft Credit Pulls, why wait? Take your equity mining to the next level today!