By: Steve Lausch, Director of Product Marketing

How To Handle “Too Many Leads”

I’ve yet to meet an automotive dealer who isn’t interested in generating more leads each month. Who doesn’t want to sell more cars and increase revenue? Those dealers just don’t seem to be out there.

On the other hand, at Dominion Dealer Solutions, we have had dealers ask for help handling the abundance of leads they receive from our equity mining solution, DealActivator. It’s been known to serve up so many new business opportunities that, often times, it’s hard to know where to begin.

To address this for our dealers, we’ve launched several product enhancements. Of those, there are two noteworthy updates for DealActivator that are of particular interest to today’s new and used car dealers.

Priority Page Mobile

Dealers can now access and work within contents of the DealActivator Priority Page directly from their personal mobile devices. The DealActivator mobile app offers a version of the Priority Page with the same great daily contact list, complete with category filtering options. It equips a dealership’s staff to text, email, and call potential in-equity customers — anywhere, anytime.

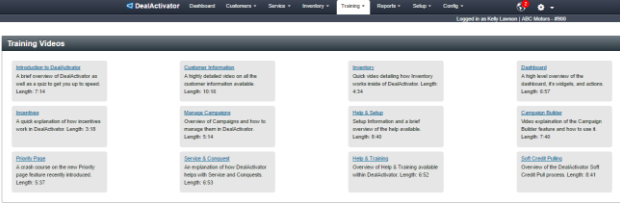

Not familiar with how the DealActivator Priority Page takes the guesswork out of who to call and when? Watch this video to learn more.

In the same way that the Priority Page helps dealers manage leads, a number of enhancements have been rolled out to the reporting available in DealActivator — especially in relationship to Soft Credit Pull (SCP) functionality.

Soft Credit Pull Reporting

Last year, Dominion released real-time and batch versions of DealActivator’s Soft Credit Pulls; each helping dealers grow conquest business in the Service lane. This new power uncovered the need for more visibility in this process for dealerships.

In response to this need, Dominion is pleased to roll out three enhanced Soft Credit Pull reports during the 2016 NADA Convention & Expo in Las Vegas, NV:

Soft Credit Pull Summary Report: a 90 day roll-up report of everything from number of pulls and conversion rates, to approval rates, tier charting, and comparison reports

Firm Offer of Credit Report: satisfies FCRA compliance, equipping the dealer to produce confirmations for all offers of credit provided to customers

Soft Credit Pull Report: a drill-down, “per customer” view of all SCPs

Interested in learning more about the industry’s leading SCP functionality and reporting? Check out Dominion’s Soft Credit Pulls and then reach out to contact us today!